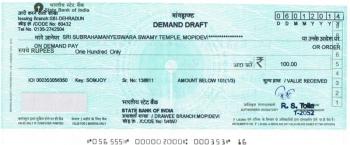

DEMAND DRAFT (D.D).

ISO 9001:2000 certified bank

DSUB–PROGRESSIVE BANK

A method used by individuals to make transfer payments from one bank account to another. Demand drafts are marketed as a relatively secure method for cashing checks. The major difference between demand drafts and normal checks is that demand drafts do not require a signature in order to be cashed.

Demand Draft Charges I.B.C / O.B.C:

1. Up to Rs.10000/-: Rs.20/- , Above1 Rs.10000/- : Per Thousand Rs.1.00/-.

2. Duplicate Demand Draft / Pay Order : Rs.100/-(Take Indemnity).

3. Cancel Duplicate DD : Rs.100/-.

4. RTGS1 : Up to 1 Lakh to 5 lakh Rs.25/- Per chalan.

4. NEFT1 : Above Rs.1 Lakh Rs.25/- Per chalan.

All these aim to provide convenient, efficient, and high quality banking experience to the customers, comparable to world class standards.